Professional Indemnity Checklist: This Is the Info You Need to Get a Policy in 5 Minutes

Claims for damages or warning letters are risks that self-employed individuals and freelancers face every day. That is why a proper hedging is part of good business planning right from the start. At exali, you only need five minutes and some information about your self-employment or your company to take out professional indemnity insurance. We reveal what is asked in the online questionnaire ...

Minute 1: Your Previous Year's Sales or the Estimated Sales

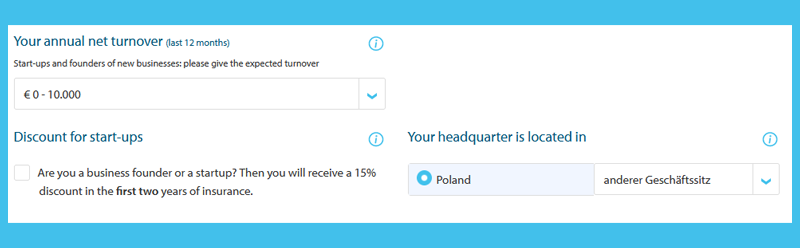

In order for your insurance to withstand every claim for damages, it is important that you state your annual net sales. This means your previous year's net turnover. Have you just founded your company? No problem, just give your realistic estimate of the expected turnover. You have probably already done this for your business plan or you had to inform the trade office. You can use these numbers as a reference point.

Incidentally, the smallest sales range for exali professional indemnity insurance is between 0 euro and 10.000 euro and is therefore ideal if you have no idea how much turnover you will generate in the coming year. Even if your sales are higher, you are still fully covered. In addition, the premium for the current year will not be recalculated, but will only be adjusted to your sales in the following year.

When Is the Right Time for Professional Indemnity Insurance?

Professional indemnity insurance for self-employed individuals and freelancers can be taken out at any time. However, there are good reasons to combine the insurance date and the start of self-employment.

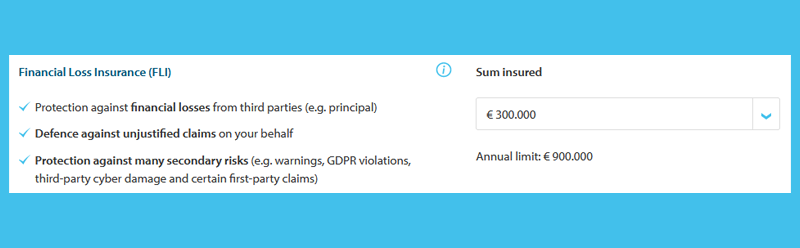

Minute 2: Assess Your Risk Correctly

Next, you need to choose the appropriate insurance sum. That is the amount - insurance jargon also refers to it as the limit - that the insurer will pay in a damage event. The sums imsured with the exali professional indemnity insurance are maximised three-fold. This means that the limit, i.e. the maximum sum insured, is available three times a year for the payment of claims. If the limit is not exhausted in a damage event, more than three claims can of course be accepted per year. If the damage is higher than the sum insured, you have to pay the difference yourself.

However, you should not choose the largest amount across the board, as this affects the amount of your payable premium. Instead, think about how high you would put the risk of your professional activity or the current project. What would the greatest possible damage be that you could realistically cause? Are you principals only small business owners or do you work with corporations, international companies or celebrities? Would a delay in service provision on your part result in further delays for the principal, which could result in high costs? Nobody knows your business better than you, so run through a few scenarios in your mind and, if in doubt, choose a higher insured sum. You can easily and transparently try out how your choice affects the insurance premium in the online calculator.

Minute 3: Do You Already Have a General and Personal Liability Insurance for Your Business?

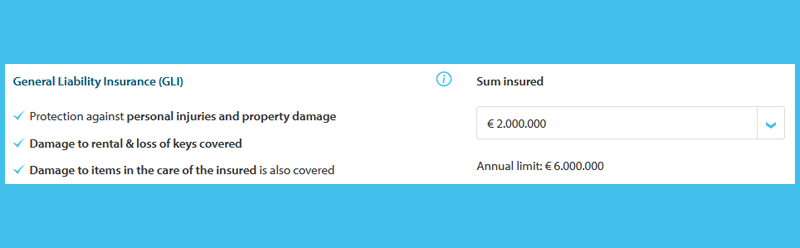

General and personal liability insurance is just as much a part of comprehensive coverage as financial loss insurance. It is also known as trip insurance because it covers personal injuries and property damage. It also includes financial losses that can be traced back to such damages.

Are you not engaged with direct customer contact? Nevertheless, do not decide too quickly against protection against personal injuries and property damage. Even without direct contact, your professional activities can cause such damage.

For general and personal liability insurance for business, insurance sums between 2 and 10 million euros are usually available. Here, too, better to choose the amount that is appropriate for your risk (company size, type of principal, type of activity).

If you already have office and business personal liability insurance, you can also deselect it. Otherwise, a professional indemnity solution without personal liability insured sum is expressly not recommended. Because if a person is harmed through your fault, the costs for treatment and possible compensation for pain and suffering can quickly endanger your professional survival.

Minute 4: Protect Individual Risks with Add-ons

If you have made it this far, you have chosen solid basic protection that may be sufficient for your company. However, there are activities that involve particular risks. With the add-on called ‘first-party cyber and data risks insurance (FPC)’, you can adapt your insurance to the needs of your company and your industry without paying for something you don't need.

Minute 5: Company Data and Questions about Your Business Model

In the last step, you will be asked a number of questions, the so-called risk questions, which you must answer with ‘yes’ or ‘no’. These differ depending on the professional field and ask about specific and usually special risks, which can then lead to an increase in the premium, additional agreements and, in exceptional cases, to the rejection of the application. Should you have to answer one of these questions with ‘yes’, you can still submit your questionnaire online, the contract simply cannot be activated immediately. In this case, one of our insurance experts will call you to offer coverage that is individually tailored to your risks.

Then you enter your personal information such as the name of your company, the address and the desired start of insurance. An overview page lets you check your selection again before submitting it and make corrections if necessary.

All Done? Follow This Link to Take out Your Professional Indemnity Insurance

Now you know what information we need from you if you want to take out Professional Indemnity I Insurance for Digital Professions with exali. Any questions? Not a problem: Even if you can take out your insurance with us online in a few minutes, our customer service will be happy to help you over the phone and go through the application process with you. Nevertheless, you should have the aforementioned information at hand so that we can help you quickly.

Calculate your premium and get your professional indemnity insurance online in just a few steps here:

Content-Manager

With over 10 years of professional experience in online marketing at various platforms and online stores, project manager Kathrin Bayer provides valuable tips that go beyond current trends.

When she writes articles for exali, they mostly revolve around SEO or SEA risks, e-commerce and online trade or the media industry. She is on fire for all online marketing areas, combining experience with curiosity.