Professional Indemnity Insurance - Demystified!

Working on a self-employed basis comes with plenty of freedom – but also with responsibility. If you cause damage to a third party, you could face a compensation claim that puts your financial livelihood at serious risk. That’s where Professional Indemnity Insurance comes in. In this article, we’ll show you exactly how it protects your business.

What is Professional Indemnity Insurance?

Self-employed professionals and freelancers are personally liable for mistakes made in their business – often with their private assets at stake. This is exactly where Professional Indemnity Insurance steps in. It covers the cost of claims if your professional activity causes damage to someone else and you are held liable. Here’s what that could look like in practice:

Imagine you’re working in IT and programming an online shop. A mistake slips in, and the shop is offline for several days. Your client claims compensation for repair costs and lost revenue. With Professional Indemnity Insurance in place, those costs are covered.

For certain professions, Professional Indemnity Insurance is mandatory – depending on the country in which you work. Find out in our article whether you are legally required to have it too: Professional Indemnity Insurance: Who Needs To Be Insured?

Want to learn more? In this video, we explain exactly what Professional Indemnity Insurance is – clear, concise and easy to understand.

Which risks does Professional Indemnity Insurance cover?

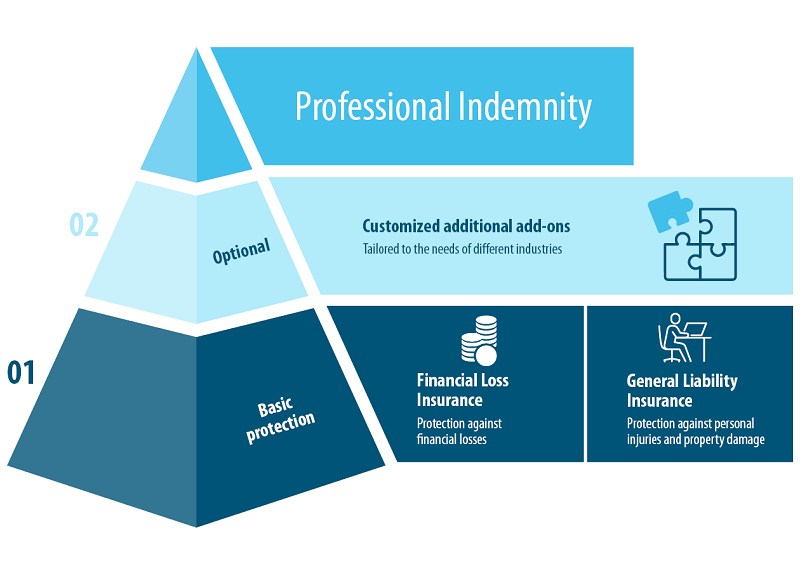

Professional Indemnity Insurance with exali is made up of several key components:

Financial Loss Liability Insurance:

It covers pure financial losses – that is, financial damage suffered by third parties as a result of a professional error or omission on your part.

General Liability Insurance can be included in a Professional Indemnity Insurance policy – but it doesn’t have to be. With Professional Indemnity Insurance from exali, General Liability Insurance is already part of the basic package. This protects your business against personal injury and property damage claims.

What is the difference between Professional Indemnity Insurance and General Liability Insurance?

The difference between Professional Indemnity Insurance and General Liability Insurance often causes confusion. Our article sheds light on the topic: The Difference Between Professional Indemnity and General Liability

When does Professional Indemnity Insurance step in?

Your Professional Indemnity Insurance is there for you if a third party holds you liable for a professional error. If the claim is justified, the insurer determines the exact amount of the damage and covers the costs. If the claim is unfounded, it will be defended on your behalf. The key point: in case of a damage event, you should contact your insurer immediately to receive full support.

Find out more in this article about when Professional Indemnity Insurance pays out – and when it doesn’t: When Does Professional Indemnity Insurance Pay and When Does It Not?

Got questions? Our Customer Service experts have the answers! You can reach us Monday to Friday from 9:00 a.m. to 6:00 p.m. (CET) on +49 (0) 821 80 99 46-0. Alternatively, feel free to use our contact form.

Vivien Gebhardt is an online editor at exali. She creates content on topics that are of interest to self-employed people, freelancers and entrepreneurs. Her specialties are risks in e-commerce, legal topics and claims that have happened to exali insured freelancers.

She has been a freelance copywriter herself since 2021 and therefore knows from experience what the target group is concerned about.